The Wharton Research Data Service (WRDS) data set and Factor Model Factors

Information wants to be free

Attributed to Stewart Brand

On the one hand information wants to be expensive, because it's so

valuable. The right information in the right place just changes your

life.

Steve Wozniak, co-founder of Apple Computer

Table of Contents

Introduction

This page started out as a set of notes that I wrote while I was

working with the Wharton Research Data Service (WRDS) data set for my Masters

presentation in Computational Finance and Risk Management Masters at

the University of Washington, on November 22, 2013.

I am grateful that I had access to the WRDS databases. Without this

access I would not have been able to do my Masters presentation work. This is a

fantastic resource for graduate students and researchers.

Locating the data that I needed within the WRDS data bases and

cleaning up the data so that it could be used in my Masters

presentation proved

to be extremely time consuming. At one point I worried that I would

end up giving my Masters presentation on data preparation since this

work had consumed so much time. I hope that these notes will help

others navigate the WRDS data (and spend less time on the data and

more on their research).

Pension funds, endowments, hedge funds and other investment groups

spend tens of thousands, or hundreds of thousands of dollars a year on

market data. Some of these "industry" data sources are available

through the Wharton Research Data Service. I don't know if there are

differences in the quality of the academic databases vs. those

provided to industrial subscribers.

Apparently different academic subscribers have

different levels of access. So these notes are not comprehensive: a

subscription may have more or less data access than is noted here.

Some of these data sources, like the Fama French data may be available

elsewhere (e.g., Kenneth

French's web site).

I have focused on data sets that are useful for building

portfolio factor models based on corporate balance sheet data

(earnings per share, etc...). To explore the WRDS data, I first used the S&P

100 stocks and then later, the S&P 500 stocks. Most of the detail

here involves stocks in the CRSP/Compustat S&P 500 index, from 1998 to

2013.

The WRDS data can be difficult to navigate. Each data set has a

variety of sub-data sets. Even after reading the documentation it can

be difficult to understand what is contained in the data set or how complete

it is. These notes reflect many hours spent exploring the WRDS data set.

In most cases the descriptions of the data sets consist of edited

versions of the description provided on the WRDS web site.

-

AuditAnalytics

Audit Analytics provides detailed research on over 150,000 active

audits and more than 10,000 accounting firms.

Audit and Compliance datasets covers all SEC registrants. Audit

Analytics data includes the tracking and analysis of public company

disclosures related to the audit, compliance, governance, corporate

actions and federal litigation.

-

Bank Regulatory

This database contains five databases for regulated depository financial

institutions. These databases provide accounting data for bank holding

companies, commercial banks, savings banks, and savings and loans

institutions. The source of the data comes from the required

regulatory forms filed for supervising purposes. Please see the

Federal Reserve Bank of Chicago website for more information.

-

Blockholders

This dataset contains standardized data for blockholders of 1,913

companies. The data was cleaned from biases and mistakes usually

observed in the standard source for this particular type of

data. Blockholders' data is reported by firm for the period 1996-2001.

-

Bureau van Dijk

Bureau van Dijk (BvD) is widely recognized as a specialist provider of

both public and private company information within the academic

community.

WRDS currently offers users with the following company information

databases through BvD's Orbis product:

-

Amadeus: European public and private company information

-

Bankscope: Global banking information

-

Osiris: Globally listed, as well as major unlisted or delisted

companies

-

CBOE Indexes (various versions of the VIX index)

The CBOE (Chicago Board Options Exchange) Volatility Index is a key

measure of market expectations of near-term volatility conveyed by S&P

500 stock index option prices. The Vix Index was introduced in 1993 by

Professor Robert E. Whaley of Duke University in his paper

Derivatives on Market Volatility: Hedging Tools Long Overdue

Journal of Derivatives 1 (Fall 1993), pp. 71-84. Since then, VIX has

been considered by many to be the world's premier barometer of

investor sentiment and market volatility.

The New VIX still measures the market's expectation of 30-day

volatility, but in a way that conforms to the latest thinking and

research among industry practitioners. The New VIX is based on S&P 500

index option prices and incorporates information from the volatility

"skew" by using a wider range of strike prices rather than just

at-the-money series.

-

Compustat from Standard and Poors

This database includes:

-

North America

This is a database of U.S. and Canadian fundamental and market information on

active and inactive publicly held companies. It provides more than 300

annual and 100 quarterly Income Statement, Balance Sheet, Statement of

Cash Flows, and supplemental data items.

-

Global

This is a database of non-U.S. and non-Canadian

fundamental and market information on more than 33,900 active and

inactive publicly held companies with annual data history from 1987.

-

Bank

-

Historical Segments

-

Snapshot

-

Capital IQ

Compustat has a wide variety of data, so it is difficult to

characterize. Compustat includes daily and monthly security

prices.

For those building factor models, Compustat has a data section labeled

Simplified Finance Statement Extract that includes monthly corporate

factors. The data appears to have fewer missing values than the IBES

data. Also, unlike IBES, the Compustat data is returned in columnar

format (factors per month, with the factors as the columns) so

software is not necessary to assemble a table of factors. However,

when I queried for the S&P 100 stocks, values for only a few stocks

where returned.

Compustat also includes the components of various

indices (e.g., computer software, chemicals, etc). It also includes

index prices. It should be possible to construct beta values for the

various indices from this data.

-

CRSP

Perhaps the most famous research database. The Center for Research in

Security Prices (CRSP) maintains the most comprehensive collection of

security price, return, and volume data for the NYSE, AMEX and NASDAQ

stock markets. Additional CRSP files provide stock indices, beta- and

cap-based portfolios, treasury bond and risk-free rates, mutual funds,

and real estate data.

-

CUSIP

The CUSIP Master Files provide CUSIP numbers, standardized

descriptions and additional data attributes for over 5 million

corporate, municipal and government securities offered in North

America.

-

DMEF Academic Data (Direct Marketing Educational Foundation) Not of

much interest to quants.

-

Dow Jones

The Dow Jones Averages are comprised of The Daily and Monthly Dow

Jones Composite (DJA), as well as The Dow Jones Industrial (DJI), The

Dow Jones Transportation (DJT), The Dow Jones Utility (DJU), The Dow

10, and The Dow 5.

-

FDIC

The Federal Deposit Insurance Corporation (FDIC) datasets contains

historical financial data for all entities filing the Report of

Condition and Income (Call Report) and some savings institutions

filing the OTS Thrift Financial Report (TFR). These entities include

commercial banks, savings banks, or savings and loans.

-

Fama French & Liquidity Factors

The Fama-French Portfolios are constructed from the intersections of

two portfolios formed on size, as measured by market equity (ME), and

three portfolios using the ratio of book equity to market equity

(BE/ME) as a proxy for value. Returns from these portfolios are used

to construct the Fama-French factors.

-

Federal Reserve Bank

-

GovPX - Tick-by-tick data after 2009.

Data must be searched by CUSIP. It's not clear from the WRDS

description how large an asset universe is covered or even what the

assets are.

-

I/B/E/S

I/B/E/S (IBES) International Inc. created their Academic Research Program

over 30 years ago to provide both summary and individual analyst

forecasts of company earnings, cash flows, and other important

financial items, as well as buy-sell-hold recommendations.

The IBES values are returned with one value (Cash Flow per Share -

CPS) on a line. Building a table from this data can be a challenge and

I wrote some Java code to do this.

-

ISSM (The Institute for the Study of Security Markets)

The Institute for the Study of Security Markets (ISSM) database

contains tick-by-tick data covering the NYSE and AMEX between 1983 and

1992, and NASDAQ between 1987 and 1992. Each year of data is divided

into two files, one for trades and one for quotes.

-

Markit Trial (credit default swap database)

-

PHLX (Philadelphia Stock Exchange)

Currency and implied volatility option database.

-

Penn World Tables (national (country) income data)

-

Risk Metrics

RiskMetrics (through ISS Governance Services) is a leader in corporate

governance data. RiskMetrics delivers to data for the new methodology to WRDS in four

datasets identified as:

-

RiskMetrics Group Historical Governance

-

Historical Directors data

-

Voting Results data

-

Shareholder Proposal data

-

SEC Order Execution

On November 15, 2000, the SEC adopted new rules aimed at improving

public disclosure of order execution and routing practices. As a

result of Rule 11Ac1-5, market centers that trade national market

system securities must make monthly, electronic disclosures of basic

information concerning their quality of executions on a stock-by-stock

basis, including how market orders of various sizes are executed

relative to the public quotes and information about effective spreads

- the spreads actually paid by investors whose orders are routed to a

particular market center. In addition, market centers must disclose

the extent to which they provide executions at prices better than the

public quotes to investors using limit orders.

Data is available on WRDS through 2005, and is no longer updated.

-

TAQ (Trade And Quote database)

The Trade and Quote (TAQ) database contains intraday transactions data

(trades and quotes) for all securities listed on the New York Stock

Exchange (NYSE) and American Stock Exchange (AMEX), as well as Nasdaq

National Market System (NMS) and SmallCap issues.

The Reg SHO - NYSE Short Sales database contains data related to SEC

Regulation SHO per the terms of the SRO requirement to make Short Sale

transactions data available on a monthly basis for trade dates

beginning January 2005 through the pilot period ending April

2006. (SROs are self-regulatory organizations in the securities

industry, such as the NYSE, that create and enforce rules for its

members based on the federal securities laws.)

-

TRACE (OTC Corporate Bond and Agency Debt Bond Transaction Data)

-

Thomson Reuters

Mutual fund holdings, institutional holdings, insider data, stock

ownership summary.

-

Zacks Trial

Analysts forecast database (e.g., Earnings per Share consensus,

surprise, etc). The trial dataset is limited date range for 100 of the largest global companies.

As far as I can tell, of the data sets that I have access to, there

are only two that contain corporate factor data: IBES and Compustat.

The IBES data also includes analysts forcasts.

The IBES data set can be selected in a variety of ways. The IBES Detail

History - Actuals data set appears to be the most promising when

it comes to corporate factors (e.g., earnings per share, cash flow per

share). Here "actual" values are in contrast to the forecast values.

The IBES data is surprising in its ommissions. Almost every stock has

periods where there are no values provided for Book Value per Share,

Cash Flow per Share and Return on Equity. This makes this data set

difficult or impossible to use. Given what IBES charges for data I can

only hope that they provide better quality for their industry

subscribers.

IBES Detail History - Actuals

The IBES database has quarterly stock factor data. I experimented

with selecting the factors shown below:

-

EPS - Earnings per share

-

BPS - Book Value Per share

-

CPS - Cash Flow Per Share

-

CSH - Cash Earnings Per Share

-

DPS - Dividend Per Share

-

EBG - Earnings per share - before goodwill

-

EBS - EBITDA per share

-

FFO - Funds from operations per share

-

GPS - GAAP/Earnings Per share - fully reported

-

GRM - Gross margin (percent, GRM)

-

OPR - Operating Profit (non-per share)

-

ROA - Return on Assets (percent)

-

ROE - Return on Equity (percent)

-

SAL - Revenue (non per share)

The SAL factor (revinue non-per-share) does not seem to be a useful

factor since it needs to be scaled by the number of shares or the

corporate size (capitalization).

Unlike the Compustat data, which is returned in tabular form, the IBES

data is returned with one factor per line. This is shown below. The

column names are:

| OFTIC | Official ticker |

| TICKER | IBES ticker |

| PENDS | period end |

| MEASURE | e.g., the factor EPS, BPS, CPS... |

| PDICITY | periodicity (e.g., quarterly, yearly) |

| VALUE | the factor value |

| ANNDATES | Announcement date |

OFTIC,TICKER,PENDS,MEASURE,PDICITY,VALUE,ANNDATS

AEP,AEP,12/31/2004,EPS,QTR,0.42,01/27/2005

AEP,AEP,03/31/2005,EPS,QTR,0.88,04/28/2005

AEP,AEP,06/30/2005,EPS,QTR,0.61,07/29/2005

AEP,AEP,09/30/2005,EPS,QTR,0.95,10/27/2005

AEP,AEP,12/31/2005,EPS,QTR,0.29,02/01/2006

AEP,AEP,03/31/2006,EPS,QTR,0.96,04/27/2006

AEP,AEP,06/30/2006,EPS,QTR,0.44,07/27/2006

AEP,AEP,03/31/2006,BPS,QTR,23.82,04/28/2006

...

AEP,AEP,06/30/2006,BPS,QTR,23.8,07/27/2006

AEP,AEP,09/30/2006,BPS,QTR,24.05,10/31/2006

AEP,AEP,12/31/2006,BPS,QTR,23.83,01/30/2007

AEP,AEP,03/31/2007,BPS,QTR,23.94,04/26/2007

AEP,AEP,06/30/2007,BPS,QTR,24.22,07/31/2007

AEP,AEP,09/30/2007,BPS,QTR,24.76,10/24/2007

AEP,AEP,12/31/2007,BPS,QTR,25.31,01/29/2008

AEP,AEP,03/31/2008,BPS,QTR,,04/28/2008

To allow this data be used in an environment like R the data needs to

be in a tabular format, like that shown below:

| sym | date | anndate | BPS | CPS | CSH | DPS | EBG | EBS | EPS | FFO | GPS | GRM | ROA | ROE | SAL |

| AEP | 2004-12-31 | 2005-01-27 | NA | 0.447 | NA | 0.35 | NA | NA | 0.42 | NA | 0.42 | NA | NA | NA | 3500.0

|

| AEP | 2005-03-31 | 2005-04-28 | NA | 0.7685 | NA | 0.35 | NA | NA | 0.88 | NA | 0.9 | NA | NA | NA | 3000.0

|

| AEP | 2005-06-30 | 2005-07-29 | NA | 0.7765 | NA | 0.35 | NA | NA | 0.61 | NA | 0.58 | NA | NA | NA | 2800.0

|

| AEP | 2005-09-30 | 2005-10-27 | NA | 1.8355 | NA | 0.35 | NA | NA | 0.95 | NA | 0.99 | NA | NA | NA | 3300.0

|

| AEP | 2005-12-31 | 2006-02-01 | NA | 0.354 | NA | 0.37 | NA | NA | 0.29 | NA | -0.38 | NA | NA | NA | 2900.0

|

| AEP | 2006-03-31 | 2006-04-27 | 23.82 | 1.8 | NA | 0.37 | NA | NA | 0.96 | NA | 0.97 | NA | 1.06 | 11.69 | 3100.0

|

| AEP | 2006-06-30 | 2006-07-27 | 23.8 | 1.53 | NA | 0.37 | NA | NA | 0.44 | NA | 0.44 | NA | 0.47 | 10.98 | 2900.0

|

| AEP | 2006-09-30 | 2006-10-31 | 24.05 | 2.28 | NA | 0.37 | NA | 2.89 | 0.99 | NA | 0.67 | NA | 1.08 | 11.09 | 3600.0

|

| AEP | 2006-12-31 | 2007-01-30 | 23.83 | NA | NA | 0.39 | NA | 2.89 | 0.38 | NA | 0.46 | NA | 0.4 | 11.61 | 3000.0

|

| AEP | 2007-03-31 | 2007-04-26 | 23.94 | NA | NA | 0.39 | NA | 2.35 | 0.68 | NA | 0.68 | NA | 0.71 | 10.34 | 3200.0

|

| AEP | 2007-06-30 | 2007-07-31 | 24.22 | NA | NA | 0.39 | NA | 2.31 | 0.64 | NA | 0.45 | NA | 0.66 | 11.09 | 3100.0

|

| AEP | 2007-09-30 | 2007-10-24 | 24.76 | NA | NA | 0.39 | NA | 3.31 | 1.16 | NA | 1.02 | NA | 1.17 | 11.51 | 3800.0

|

| AEP | 2007-12-31 | 2008-01-29 | 25.31 | NA | NA | 0.41 | NA | NA | 0.52 | NA | 0.58 | NA | 0.52 | 11.9 | 3300.0

|

| AEP | 2008-03-31 | 2008-04-24 | NA | 1.56 | NA | 0.41 | NA | 2.9 | 1.02 | NA | 1.43 | 64.15 | NA | NA | 3467.0

|

Note that NA has been filled in for missing values.

I wrote a Java program (ConvertData.java) to convert the

WRDS IBES value per line data into the table shown above (a

downloadable form can be found here).

The WRDS query interface allows you to select a file on your local

system that contains the stock ticker symbols for the query. I used a

file that contained the S&P 100 stocks (note that the composition of

the S&P 100 and other indexes change over time):

|

S&P 100 Stocks (as of October 2013)

|

| AAPL | ABBV | ABT | ACN | AEP | AIG | ALL | AMGN | AMZN | APA |

| APC | AXP | BA | BAC | BAX | BK | BMY | BRK.B | C | CAT |

| CL | CMCSA | COF | COP | COST | CSCO | CVS | CVX | DD | DIS |

| DOW | DVN | EBAY | EMC | EMR | EXC | F | FCX | FDX | FOXA |

| GD | GE | GILD | GM | GOOG | GS | HAL | HD | HON | HPQ |

| IBM | INTC | JNJ | JPM | KO | LLY | LMT | LOW | MA | MCD |

| MDLZ | MDT | MET | MMM | MO | MON | MRK | MS | MSFT | NKE |

| NOV | NSC | ORCL | OXY | PEP | PFE | PG | PM | QCOM | RTN |

| SBUX | SLB | SO | SPG | T | TGT | TWX | TXN | UNH | UNP |

| UPS | USB | UTX | V | VZ | WAG | WFC | WMB | WMT | XOM |

You can download the stocks in list form here.

Although the IBES search has a check box for each of the factors

above, many of them have no data or many missing values (for example,

CPH, EBG, FFO, GRM). In some cases, not all time periods have all of

the factors selected in the query (e.g., values are not supplied

as empty values, but are omitted entirely for the time period).

I tried selecting fewer factors and got a data set with fewer missing

values. For some stocks there are still enough missing values to make this data

set problematic.

| sym | date | anndate | BPS | CPS | DPS | EPS | ROE | SAL |

| BA | 2005-03-31 | 2005-04-27 | 14.23 | 1.755 | 0.25 | 0.66 | 15.32 | 12987.0

|

| BA | 2005-06-30 | 2005-07-27 | 13.79 | 1.87 | 0.25 | 0.7 | 15.62 | 15028.0

|

| BA | 2005-09-30 | 2005-10-26 | 11.74 | 1.84 | 0.25 | 1.26 | 24.37 | 12629.0 |

| BA | 2005-12-31 | 2006-02-01 | 13.97 | 1.862 | 0.25 | 0.58 | 23.28 | 14204.0 |

| BA | 2006-03-31 | 2006-04-26 | 14.55 | 1.84 | 0.3 | 0.88 | 23.71 | 14264.0 |

| BA | 2006-06-30 | 2006-07-26 | 13.62 | 0.73 | 0.3 | -0.21 | 19.33 | 14986.0 |

| BA | 2006-09-30 | 2006-10-25 | 14.06 | 2.25 | 0.3 | 0.89 | 15.29 | 14739.0 |

| BA | 2006-12-31 | 2007-01-31 | 6.02 | 3.12 | 0.3 | 1.29 | 46.74 | 17541.0 |

| BA | 2007-03-31 | 2007-04-25 | 7.22 | 0.94 | 0.35 | 1.12 | 42.7 | 15365.0 |

| BA | 2007-06-30 | 2007-07-25 | 7.54 | 4.68 | 0.35 | 1.35 | 61.55 | 17028.0 |

| BA | 2007-09-30 | 2007-10-24 | 8.28 | 4.3 | 0.35 | 1.43 | 62.75 | 16517.0 |

| BA | 2007-12-31 | 2008-01-30 | 11.83 | 2.49 | 0.35 | 1.35 | 45.07 | 17477.0 |

| BA | 2008-03-31 | 2008-04-23 | 12.13 | 2.59 | 0.4 | 1.61 | 48.43 | 15990.0 |

The IBES time series with the fewest missing values is the earnings

per share actual value. However, not all dates are covered.

S&P 500 Index Components

Compustat Monthly Updates - Index Constituents

Stocks are added and removed from the S&P 500 over time. When modeling

portfolio performance with historical data it is important to use the

historical S&P 500 to avoid survivor bias. Also, some stocks, like

Google, have existed only relatively recently.

In order to download the historical S&P 500, the index for various

time periods must be calculated. Some stocks do not exist anymore and

are replaced by CRSP/Compustat codes. A file of GVKEY values must be

generated to download the factors discussed here. See Building

the S&P 500 Constituents. The web page include a link to R code

that will build the index and the GVKEY file.

Forrester Research analyst Sucharita Mulpuru told the Times that

Amazon was "the teacher's pet of Wall Street," because no other company

in the world "has the consistently abominable rate of profitability

they do and yet has the stratospheric valuation they do."

http://www.salon.com/2013/10/25/why_wall_street_cant_quit_amazon

The raw numbers would seem to indicate that Microsoft is killing it

while Amazon is floundering. But Wall Street disagrees: On Friday

morning Microsoft's stock price hovered around $35 per share while Amazon rose

to $357.

http://www.salon.com/2013/10/25/what_microsoft_profits_say_about_amazon_losses/Microsoft

Of the databases available on WRDS, the CRSP/Compustat combined database seems to be the most extensive

database of fundamental corporate information. This is the core data

that I used for my Masters presentation.

This data consists of corporate factors from the quarterly

corporate filings.

Corporations in different industrial sections differ in fundamental

ways. A transportation company (trucking, railroad) has large capital

equipment expenditures and depreciation, but no research and

development expenses. A pharmaceutical company has research and

develpment costs, capital costs for drug manufacture and

depreciation. A software company has research and development costs

but low capital expenses (outside of buildings and computers). Each

of these companies will have different corporate factors.

Corporate reports contain a staggering number of categories. For

those of us without the benefit of MBA or CPA graduate degrees, some of these

factors are confusing. Another problem is that in many cases there

are missing factors.

The tables below show the density of the factors, relative to the S&P

500 from January 1998 to September 2013. For example,

[100.00:95.00] means that between 95 and 100 percent of the values are

present (e.g., not NA).

In some cases the fact values are missing is valid. For example, not

all stocks have dividends, so it is reasonable that dividend values

are missing for some stocks.

[100.00:95.00]

| PRCCQ | CSHPRQ | CSH12Q | SALEQ | IBADJQ | IBCOMQ | ATQ | LSEQ |

| IBQ | LTMIBQ | NIQ | LTQ | SEQQ | ICAPTQ | PIQ | CSHOQ |

| AOQ | CHEQ | EPSPIQ | EPSFIQ | CEQQ | OPEPSQ | EPSPXQ | COGSQ |

| EPSFXQ | XOPRQ | EPSX12 | OEPS12 | OIADPQ | CSHFDQ | DILAVQ | OEPSXQ |

| EPSF12 | TXTQ | APQ | RECTQ | REQ | CSTKQ | OANCFY | CHECHY |

[95.00:90.00]

| REVTQ | LOQ | PPENTQ | OEPF12 | DLTTQ | OIBDPQ |

[90.00:85.00]

[85.00:80.00]

| LCOQ | LCTQ | ACTQ | WCAPQ | XINTQ | DLCQ | INVTQ |

[80.00:75.00]

| XSGAQ | ANCQ | LLTQ | IBADJ12 | SPCEPQ |

[75.00:70.00]

| SPCEEPSPQ | SPCEDPQ | SPCEQ | SPCEEPSQ | SPCEDQ |

[70.00:65.00]

| SPCEP12 | SPCEEPSP12 | SPCEPD12 | REUNAQ | DPACTQ | PPEGTQ | SPCE12 | SPCEEPS12 |

| SPCED12 | ACOMINCQ |

[65.00:60.00]

[60.00:55.00]

[55.00:50.00]

| TXDITCQ | TSTKNQ | TXPQ | LOXDRQ | SPIQ |

[50.00:45.00]

| CITOTALQ | PNCWIAPQ | PNCWIPPQ | CIBEGNIQ | PNCPQ | STKCOQ | PNCWIAQ | PNCWIPQ |

PNCQ | INTANOQ | RECTRQ | GLCEA12 |

|

[45.00:40.00]

[40.00:35.00]

| CHQ | GLCEEPS12 | GLCED12 | IVLTQ | PRCPQ | CICURRQ | PRCRAQ | MIBTQ |

| CSHOPQ |

[35.00:30.00]

| PRCAQ | PNCPEPSQ | PNCPDQ | PNCEPS12 | PNCD12 | PNCEPSQ | PNCDQ | PRCE12 |

| PNCPEPS12 | PNCPD12 | MIIQ | GLCEPQ | PNCWIEPQ | XRDQ | PNCWIDPQ | PNCWIEPSQ |

| RECTAQ | PNCWIDQ | XOPTQP | GLCEAQ |

[30.00:25.00]

| CIDERGLQ | AOCIPENQ | TEQQ | XIDOQ | XOPTEPSQP | XOPTDQP | TFVAQ | AOCIDERGLQ |

| CIPENQ | XOPTQ | RCPQ | CISECGLQ |

[25.00:20.00]

| RECDQ | CIQ | TXDIQ | XOPT12 | MIBQ | RCAQ | IBMIIQ | AOL2Q |

| XOPTEPSP12 | XOPTD12P | MSAQ | XOPTD12 | XOPTEPS12 | DOQ | OPTVOLQ | OPTRFRQ |

| OPTLIFEQ | XOPTEPSQ | XOPTDQ | TFVLQ | AQPL1Q | PNCIAPQ | PNCIPPQ | STKCPAQ |

| INVFGQ | GLCEEPSQ | GLCEDQ | IVSTQ | LOL2Q | RECTOQ |

[20.00:15.00]

| PNCIAQ | PNCIPQ | RCDQ | RCEPSQ | SETA12 | INVRMQ | PSTKQ | SETEPS12 |

| SETD12 | PNCIEPSPQ | PNCIDPQ | DVPQ | FCAQ | INVWIPQ | DRCQ | PNCIEPSQ |

| PNCIDQ |

[15.00:10.00]

| PSTKNQ | OPTFVGRQ | OPTDRQ | PRCEPS12 | PRCD12 | MIBNQ | PRCPEPSQ | PRCEPSQ |

| PRCDQ | PRCPDQ | PRCPEPS12 | PRCPD12 | RRA12 | CIMIIQ | AUL3Q | DILADQ |

[10.00:5.00]

| SPIOPQ | TXDBQ | AQPQ | SPIOAQ | DRLTQ | AQAQ | DCOMQ | SETPQ |

| SETAQ | CIOTHERQ | AOCIOTHERQ | SPIDQ | SPIEPSQ | LUL3Q | NRTXTQ | GDWLIA12 |

| GLPQ | SETDQ | WDPQ | AQDQ | SETEPSQ | GLAQ | GDWLID12 | GDWLIEPS12 |

| AQEPSQ | NRTXTDQ | WDAQ | DTEPQ | NRTXTEPSQ | RREPS12 | RRD12 | DTEAQ |

| LQPL1Q | UCEQQ | UACOQ | ULCOQ | UGIQ | UNIAMIQ | UOPIQ | URECTQ |

| PNRSHOQ | UAOQ | UINVQ | UNOPINCQ | UAPTQ | WDDQ | WDEPSQ | CSTKEQ |

| GLDQ | GLEPSQ | HEDGEGLQ | RRPQ | RRAQ | IVAOQ | GDWLAMQ | DTEDQ |

| DTEEPSQ |

[5.00:0.00]

| RLLQ | TIEQ | TIIQ | PSTKRQ | ESOPCTQ | NIMQ | NPATQ | PLLQ |

| NCOQ | CAPR3Q | CAPR1Q | CAPR2Q | INVOQ | NIITQ | INTACCQ | DD1Q |

| USUBPCVQ | XIQ | TXDBCAQ | UCAPSQ | XACCQ | ESUBQ | OBKQ | TXDBAQ |

| USUBDVPQ | GDWLIPQ | RREPSQ | GDWLIAQ | RRDQ | UDOLTQ | IVAEQQ | ANOQ |

| LNOQ | ACCHGQ | GDWLIDQ | GDWLIEPSQ | NPQ | USPIQ | RDIPQ | RETQ |

| RDIPAQ | DPACREQ | RECUBQ | DPRETQ | SEQOQ | ESOPTQ | TXWQ | RDIPDQ |

| RDIPEPSQ | UDMBQ | TFVCEQ | PRSHOQ | UDDQ | UPMCSTKQ | TXDBCLQ | UDPCOQ |

| FFOQ | UTEMQ | UPSTKQ | SRETQ | UDVPQ | ESOPNRQ | ARCEDQ | ARCEEPSQ |

| ARCEQ | ESOPRQ | UPMPFQ | UPMSUBPQ | AOCISECGLQ | UPDVPQ | UPSTKCQ | UCCONSQ |

| UPMPFSQ |

In most cases factors that don't have at least 2/3s of their values

are not going to be useful. The tables below list the factors, with

the description provided by Compustat.

[100.00:95.00]

| PRCCQ | Price Close - Quarter |

| CSHPRQ | Common Shares Used to Calculate Earnings Per Share

- Basic |

| CSH12Q | Common Shares Used to Calculate Earnings Per Share

- 12 Months Moving |

| SALEQ | Sales/Turnover (Net) |

| IBADJQ | Income Before Extraordinary Items - Adjusted for

Common Stock Equivalents |

| IBCOMQ | Income Before Extraordinary Items - Available for Common |

| ATQ | Assets - Total |

| LSEQ | Liabilities and Stockholders Equity - Total |

| IBQ | Income Before Extraordinary Items |

| LTMIBQ | Liabilities - Total and Noncontrolling Interest |

| NIQ | Net Income (Loss) |

| LTQ | Liabilities - Total |

| SEQQ | Stockholders Equity <Parent <Index Fundamental <Quarterly |

| ICAPTQ | Invested Capital - Total - Quarterly |

| PIQ | Pretax Income |

| CSHOQ | Common Shares Outstanding |

| AOQ | Assets - Other - Total |

| CHEQ | Cash and Short-Term Investments |

| EPSPIQ | Earnings Per Share (Basic) - Including

Extraordinary Items |

| EPSFIQ | Earnings Per Share (Diluted) - Including

Extraordinary Items |

| CEQQ | Common/Ordinary Equity - Total |

| OPEPSQ | Earnings Per Share from Operations |

| EPSPXQ | Earnings Per Share (Basic) - Excluding

Extraordinary Items |

| COGSQ | Cost of Goods Sold |

| EPSFXQ | Earnings Per Share (Diluted) - Excluding

Extraordinary items |

| XOPRQ | Operating Expense- Total |

| EPSX12 | Earnings Per Share (Basic) - Excluding

Extraordinary Items - 12 Months Moving |

| OEPS12 | Earnings Per Share from Operations - 12 Months Moving |

| OIADPQ | Operating Income After Depreciation - Quarterly |

| CSHFDQ | Common Shares for Diluted EPS |

| DILAVQ | Dilution Available - Excluding Extraordinary Items |

| OEPSXQ | Dilution Available - Excluding Extraordinary Items |

| EPSF12 | Earnings Per Share (Diluted) - Excluding

Extraordinary Items - 12 Months Mo |

| TXTQ | Income Taxes - Total |

| APQ | Account Payable/Creditors - Trade |

| RECTQ | Receivables - Total |

| REQ | Retained Earnings |

| CSTKQ | Common/Ordinary Stock (Capital) |

| OANCFY | Operating Activities - Net Cash Flow |

| CHECHY | Cash and Cash Equivalents - Increase (Decrease) |

[95.00:90.00]

| REVTQ | Revenue - Total |

| LOQ | Liabilities - Other |

| PPENTQ | Property Plant and Equipment - Total (Net) |

| OEPF12 | Earnings Per Share - Diluted - from Operations - 12MM |

| DLTTQ | Long-Term Debt - Total |

| OIBDPQ | Operating Income Before Depreciation - Quarterly |

[90.00:85.00]

| DPQ | Depreciation and Amortization - Total |

| NOPIQ | Non-Operating Income (Expense) - Total |

| CSHIQ | Common Shares Issued |

| CAPSQ | Capital Surplus/Share Premium Reserve |

| ACOQ | Current Assets - Other - Total |

[85.00:80.00]

| LCOQ | Current Liabilities - Other - Total |

| LCTQ | Current Liabilities - Total |

| ACTQ | Current Assets - Total |

| WCAPQ | Working Capital (Balance Sheet) |

| XINTQ | Interest and Related Expense- Total |

| DLCQ | Debt in Current Liabilities |

| INVTQ | Inventories - Total |

[80.00:75.00]

| XSGAQ | Selling, General and Administrative Expenses |

| ANCQ | Non-Current Assets - Total |

| LLTQ | Long-Term Liabilities (Total) |

| IBADJ12 | Income Before Extra Items - Adj for Common Stock

Equivalents - 12MM |

| SPCEPQ | S&P Core Earnings - Preliminary |

[75.00:70.00]

| SPCEEPSPQ | S&P Core Earnings EPS Basic - Preliminary |

| SPCEDPQ | S&P Core Earnings EPS Diluted - Preliminary |

| SPCEQ | S&P Core Earnings |

| SPCEEPSQ | S&P Core Earnings EPS Basic |

| SPCEDQ | S&P Core Earnings EPS Diluted |

[70.00:65.00]

| SPCEP12 | S&P Core Earnings 12MM - Preliminary |

| SPCEEPSP12 | S&P Core 12MM EPS - Basic - Preliminary |

| SPCEPD12 | S&P Core Earnings 12MM EPS Diluted - Preliminary |

| REUNAQ | Unadjusted Retained Earnings |

| DPACTQ | Depreciation, Depletion and Amortization (Accumulated) |

| PPEGTQ | Property, Plant and Equipment - Total (Gross) - Quarterly |

| SPCE12 | S&P Core Earnings 12MM |

| SPCEEPS12 | S&P Core Earnings EPS Basic 12MM |

| SPCED12 | S&P Core Earnings EPS Diluted 12MM |

| ACOMINCQ | Accumulated Other Comprehensive Income (Loss) |

[65.00:60.00]

| ALTOQ | Other Long-term Assets |

| DVPSPQ | Dividends per Share - Pay Date - Quarter |

| INTANQ | Intangible Assets - Total |

| CSTKCVQ | Carrying Value |

Most of the Compustat corporate factors listed in the table below are used to

build the factors described in Chapter 5 of Quantitative Equity

Portfolio Management by Qian, Hua and Sorensen. As the table

shows, most of these factors have few missing values.

In some cases, dividends (DVPSPQ), missing values are not unexpected,

since not all companies pay dividends.

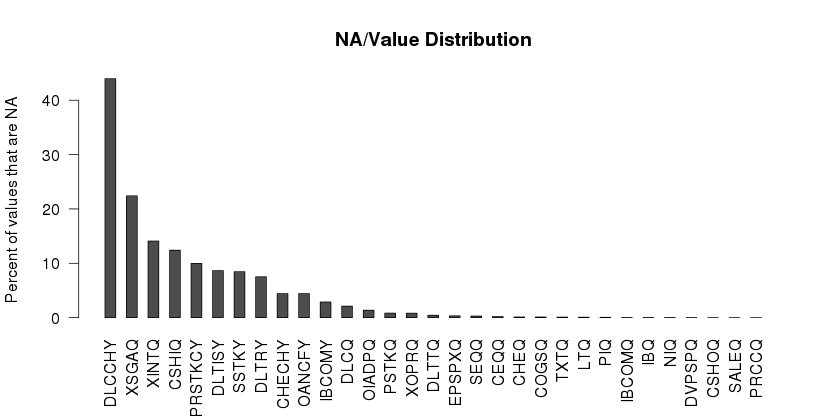

| Compustat Factors |

| Compustat Code | Explanation | Percent NA (after data cleaning) |

| CEQQ | Common/Ordinary Equity - Total | 0.21 |

| CHECHY | Cash and Cash Equivalents - Increase (Decrease) | 4.44 |

| CHEQ | Cash and Short-Term Investments | 0.13 |

| COGSQ | Cost of Goods Sold | 0.12 |

| CSHIQ | Common Shares Issued | 12.41 |

| CSHOQ | Common Shares Outstanding (thousands) | 0 |

| DLCCHY | Changes in Current Debt | 43.96 |

| DLCQ | Debt in Current Liabilities | 2.12 |

| DLTISY | Long-Term Debt - Issuance | 8.66 |

| DLTRY | Long-Term Debt - Reduction | 7.52 |

| DLTTQ | Long-Term Debt - Total (millions) | 0.44 |

| DVPSPQ | Dividends per Share - Pay Date - Quarter | 0.02 |

| DVY | Cash Dividends | 0.02 |

| EPSPXQ | Earnings Per Share (Basic) - Excluding Extraordinary Items | 0.34 |

| IBCOMQ | Income Before Extraordinary Items - Available for Common | 0.03 |

| IBQ | Income Before Extraordinary Items | 0.03 |

| LTQ | Liabilities - Total | 0.09 |

| NIQ | Net Income (Loss) | 0.03 |

| OANCFY | Operating Activities - Net Cash Flow (year to date) | 4.44 |

| OIADPQ | Operating Income After Depreciation - Quarterly | 1.38 |

| PIQ | Pretax Income | 0.06 |

| PRCCQ | Price Close - Quarter | 0 |

| PRSTKCY | Purchase of Common and Preferred Stock | 9.99 |

| PSTKQ | Preferred/Preference Stock (Capital) - Total | 0.84 |

| SALEQ | Sales/Turnover (Net) | 0 |

| SEQQ | Stockholders Equity <Parent <Index Fundamental <Quarterly | 0.30 |

| SSTKY | Sale of Common and Preferred Stock | 8.45 |

| TXTQ | Income Taxes - Total | 0.10 |

| XINTQ | Interest and Related Expense- Total | 14.10 |

| XOPRQ | Operating Expense- Total | 0.83 |

| XSGAQ | Selling, General and Administrative Expenses (millions) | 22.41 |

Note:

In the CRSP/Compustat data the REVTQ (quarterly revenue) and SALEQ

(quarterly sales) values seem to be the same. There are fewer missing

values for SALEQ, so this value is used rather than REVTQ.

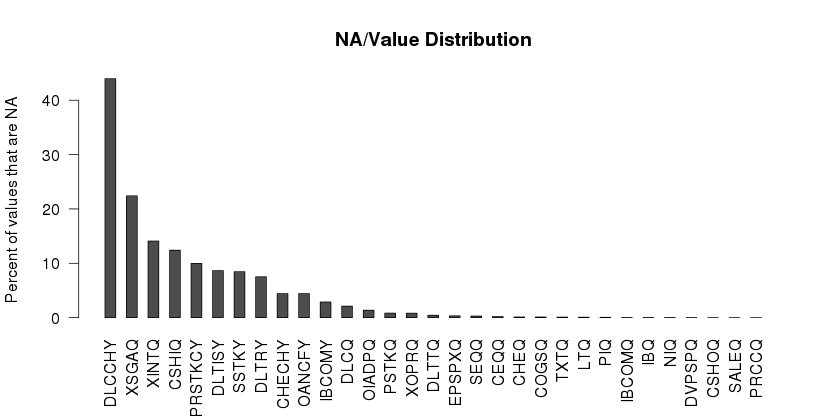

The distribution of NA (not present) values after interpolation for

quarterly values is shown below:

Additional Metadata

In some cases the date defined in the datadate column is incorrect. To allow cleaning

and filtering software to fix the dates the metadata fields (from

CRSP/Compustat) should be included.

| Metadata Fields |

| gvkey |

| datadate |

| fyear |

| fqtr |

| tic |

| conm |

| DATAFQTR |

| GGROUP |

| GSECTOR |

If you want additional verification you can also include the

DATAFQTR column in the data. This value (e.g., 1998Q1, 1998Q2)

mirrors the fyear and fqtr columns.

The GGROUP and GSECTOR are Global

Industry Classification Standard values

In our recollection, we have never encountered a large,

real-world dataset that was directly usable without data

cleaning.

Scaling Big Data Mining Infrastructure:

The Twitter Experience by Jimmy Lin and Dmitriy Ryaboy, SIGKDD

Explorations, V14, Issue 2, 2012

Fixing Date Values

The table below of Google (GOOG) data shows the correct format for the

dates. Note that the date in the datadate field mirrors the

year and quarter in the fyearq and fqtr columns.

| Consistent Data Values |

| gvkey | datadate | fyearq | fqtr | tic | conm | DATAFQTR | ATQ | etc |

| 160329 | 09/30/2004 | 2004 | 3 | GOOG | GOOGLE INC | 2004Q3 | 2888.5180 | ... |

| 160329 | 12/31/2004 | 2004 | 4 | GOOG | GOOGLE INC | 2004Q4 | 3313.3510 | ... |

| 160329 | 03/31/2005 | 2005 | 1 | GOOG | GOOGLE INC | 2005Q1 | 3865.1990 | ... |

| 160329 | 06/30/2005 | 2005 | 2 | GOOG | GOOGLE INC | 2005Q2 | 4497.7180 | ... |

| 160329 | 09/30/2005 | 2005 | 3 | GOOG | GOOGLE INC | 2005Q3 | 9451.0010 | ... |

| 160329 | 12/31/2005 | 2005 | 4 | GOOG | GOOGLE INC | 2005Q4 | 10271.8130 | ... |

The data below for Mylan Inc (MYL) shows an example where the date in

the datadate column is wrong. I have tried to check this data against

finance.yahoo.com data. It is hard to exactly match up the values,

but it does apepar that the fyearq and fqtr close price

is the correct one.

Along with being inaccurate, this date problem causes an error in R's

indexes since some datadate values are repeated.

| Inconsistent Data Values |

| gvkey | datadate | fyearq | fqtr | tic | conm | DATAFQTR | ATQ | etc |

| 007637 | 03/31/1998 | 1997 | 4 | MYL | MYLAN INC | 1997Q4 | 847.7530 | ... |

| 007637 | 06/30/1998 | 1998 | 1 | MYL | MYLAN INC | 1998Q1 | 890.8990 | ... |

| 007637 | 09/30/1998 | 1998 | 2 | MYL | MYLAN INC | 1998Q2 | 924.4280 | ... |

| 007637 | 12/31/1998 | 1998 | 3 | MYL | MYLAN INC | 1998Q3 | 1158.3130 | ... |

| 007637 | 03/31/1999 | 1998 | 4 | MYL | MYLAN INC | 1998Q4 | 1206.6610 | ... |

| 007637 | 06/30/1999 | 1999 | 1 | MYL | MYLAN INC | 1999Q1 | 1241.1060 | ... |

| 007637 | 09/30/1999 | 1999 | 2 | MYL | MYLAN INC | 1999Q2 | 1259.8280 | ... |

| 007637 | 12/31/1999 | 1999 | 3 | MYL | MYLAN INC | 1999Q3 | 1309.0420 | ... |

| 007637 | 03/31/2000 | 1999 | 4 | MYL | MYLAN INC | 1999Q4 | 1341.2300 | ... |

| 007637 | 06/30/2000 | 2000 | 1 | MYL | MYLAN INC | 2000Q1 | 1364.8180 | ... |

The CRSP/Compustat Merged Database - Fundamentals Quarterly

data is extracted from the quarterly reports that public companies,

traded on US exchanges, are required to file with the SEC. There are

many factors and not all apply to all companies, so some will

naturally be zero (blank).

There are other data values that should be reported and present for all

companies. However, there are cases where these critical values are

missing in the CRSP/Compustat data.

Before the Compustat data can be used, it must be processed to add

critical values that are missing. Adding interpolated values is better

than a missing value, but this may result in estimation error.

-

CSHOQ - Common shares outstanding

This value must always be present since it is used to calculate the

market value (MV) and enterprise value (EV) for a company. If this

value is missing, it is filled in by interpolation from surrounding values.

-

PRCCQ - Quarterly close price.

If the stock is still trading the quarterly close price can be

obtained from finance.yahoo.com. If the stock is no longer

trading the value is filled in by interpolating from neighboring values

-

SALEQ - quarterly sales

This is a critical value for calculating EBITDA. If values are missing

they are filled in by interpolation.

-

CEQQ - common equity

LTQ - libilities (total)

NIQ - Net income

If there are fewer than four sequential missing values, the values are

filled in by interpolation.

Filling in missing stock values

The R package tseries includes a function, get.hist.quote, which can

be used to fetch stock values form Internet sources like

finance.yahoo.com.

The historical S&P 500 includes stocks for

companies that have been purchased by other companies or have otherwise

gone out of business (Lehman Brothers, for example). The tickers for

these stocks have been replaced by CRSP/Compustat symbols. If these

symbols are passed to the get.hist.quote function there will be an

error. This error is not an exception that can be

caught, if the quote cannot be read. This will cause the R script to terminate.

To avoid this, the R function below can be used to check whether a value can be read from

Yahoo before calling get.hist.quote().

#

# Return TRUE if the stock, on date, can be read from Yahoo

#

canGetStockInfo = function(ticker, date)

{

start = date

end = date

url <- paste("http://chart.yahoo.com/table.csv?s=", ticker,

format(start, "&a=%m&b=%d&c=%Y"),

format(end, "&d=%m&e=%d&f=%Y"), "&g=d&q=q&y=0&z=",

ticker, "&x=.csv", sep = "")

page = getURL(url)

ix = grep(pattern="404 Not Found", x = page)

readURL = (length(ix) == 0)

return(readURL)

}

The factors in this section are discussed in Chapter 5 of

Quantitative Equity Portfolio Management by Qian, Hua and

Sorensen, Chapman and Hall, 2007. These factors are synthesized from

the Compustat quarterly data (except for the earnings forecast, which

can be obtained from IBES).

In Appendex A5.1 of Qian et al there is a description of how these

factors are calculated from the Compustat

data. Unfortunately the current Compustat data available from WRDS in

2013 has a different structure. Qian et al use an obsolete Compustat

quarterly data schema, is described here.

I have listed below the calculation I have used for the selected Qian et al factors.

-

MV = market value

|

MV = CSHOQ (shares outstanding) * PRCCQ (share price)

|

-

EV = Enterprise Value - The enterprise value is what it would cost to buy

the company. This includes the market capitalization, preferred stock

or debt (a purchaser must pay of the debt to buy the company). Cash

and cash equivalents is subtracted since once the purchaser owns the

company the cash can be used to pay back part of the cost of purchase.

EV = [MV + ((debt in current liabilities) + (long term debt total) + (Preferred/Preference Stock (Capital))] - (Cash and Short-Term Investments)

EV = (MV + DLCQ + DLTTQ + PSTKQ) - CHEQ

|

-

tax rate

Interest paid is multiplied by the tax rate to produce a credit, since

corporations can deduct interest.

Qian et al calculate the cash flow numerator as: CFO + (interest

expense x (1 - tax rate)). The tax rate is not available in the

current Compustat as a percentage.

As it turns out, the corporate tax rate is complex and a lot of ink

has been spilled on this topic. See, for example, John R. Graham's

web page

discussing this.

Prof. Graham provides the tax rates for a huge number of stocks, from

1980 to 2012. However, his data has missing values (for example, some,

but not all stocks have Compustat GVKEY values).

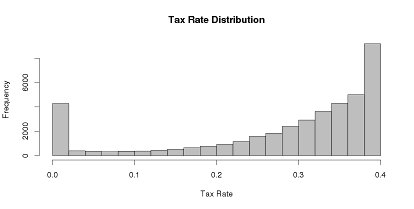

I have calculated tax rates by dividing the quarterly taxes paid by

the pretax income.

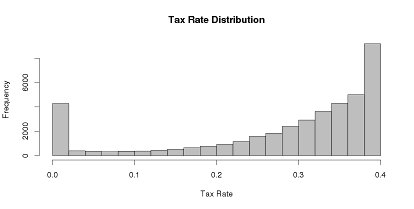

The income tax distribution is shown below (after cleaning up the data):

The mean is 28% which turns out to the the mean reported tax rate in

the US. Note that the mean actual taxes paid by corporations in the

US is less than half of this (~12%).

-

CFO2EV - Cash Flow from Operations to Enterprise Value

Cash flow is "cash flow from operating activities". This value is not

available directly on a quarterly basis. However, Compustat does

include a year-to-date value, OANCFY. By subtracting quarter t from

quarter t+1 the quarterly value can be arrived at.

CFO2EV = (Operating Activities Net Cash Flow) + ((Interest and Related Expense) x (1 - tax_rate))

ΔCFO = OANCFYt+1 - OANCFYt

CFO2EV = CFO + (XINTQ x (1 - tax_rate))

|

-

RONA - Return on net operating assets

ASSETS = (common equity) + ((debt in current liabilities) + (long term debt total) + (Preferred/Preference Stock (Capital))] - (Cash and Short-Term Investments)

ASSETS = (CEQQ + DLCQ + DLTTQ + PSTKQ) - CHEQ

RONA = [(Income Before Extraordinary Items) + ((Interest and Related Expense) x (1 - tax_rate))]/ASSETS

RONA = [IBQ + (XINTQ x (1 - tax_rate))]/ASSETS

|

-

EBITDA2EV - Earnings before Interest, Taxes, Depreciation and

Amortization to Enterprise Value

The EBITDA value is only available in the annual Compustat data.

EBITDA can be calculated as:

EBITDA = sales - (cost of goods) - (Selling, General, and Administrative Expense )

EBITDA = SALEQ - COGSQ - XSGAQ

EBITDA2EV = EBITDA / EV

|

-

E2PFY0 - Trailing 12-month earnings to market capitalization

E2PFY0 = (Income Before Extraordinary Items - Available for Common)/MV

E2PFY0 = IBCOMQ/MV

|

-

E2PFY1 - Earnings yield of IBES's EPS (earnings per share)

consensus estimate of the next fiscal year.

This estimate can be obtained form the WRDS IBES data (Detail History

- Detail File with Actuals)

-

BB2P -Net buyback to market capitalization

BB2P = ([Cash Dividend] + [Total Shares Repurchased]) - (Sale of

Common an Preferred Stock)/MV

BB2P = [(DVY + PRSTKCY) - SSTKY]/MV

|

-

BB2EV - net external financing to enterprise value

EQ_REPO = equity repurchase

EQ_REPO = ([Total Shares Repurchased] - [Sale of Common and Preferred Stock])

EQ_REPO = PRSTKCY - SSTKY

DEBT_REPO = [Long-Term Debt - Reduction] - [Changes in Current Debt] - [Long-Term Debt - Issuance]

DEBT_REPO = DLTRY - DLCCHY - DLTISY

BB2EV = [([Cash Dividend] + EQ_REPO) - DEBT_REPO]/EV

BB2EV = [(DVY + EQ_REPO) - DEBT_REPO]/EV

|

-

B2P - Book to market capitalization

|

B2P = CEQQ (common/ordinary equity) / MV (market value)

|

-

S2EV - sales-to-enterprise value

|

S2EV = SALEQ (sales) / EV

|

Preprocessing Factor Data

In the CRSP/Compustat data the yearly values are "year-to-date"

values. For example, if cash grows by 2 million a quarter, in the

first quarter the cash will be 2 million, then 4 million in the second

quarter, 6 million in the third quarter and 8 million in the fourth

quarter. If the progression continues, then in the first quarter of

the next year the cash will again be 2 million.

The yearly factors must be preprocessed to generate the quarterly

values before they are used. The yearly factors used above are:

DLTISY

DLTRY

OANCFY

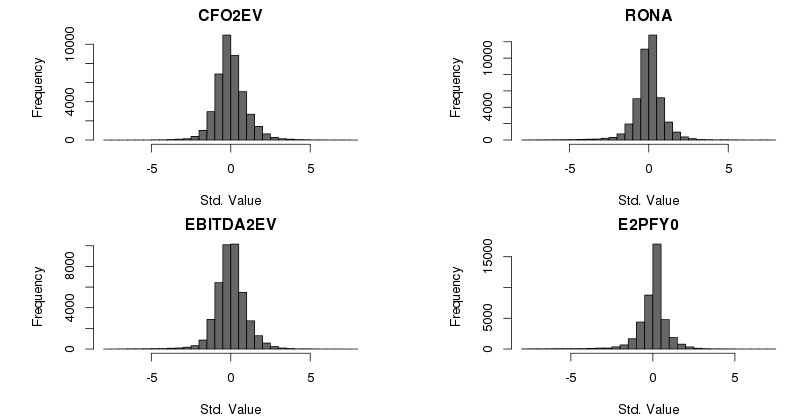

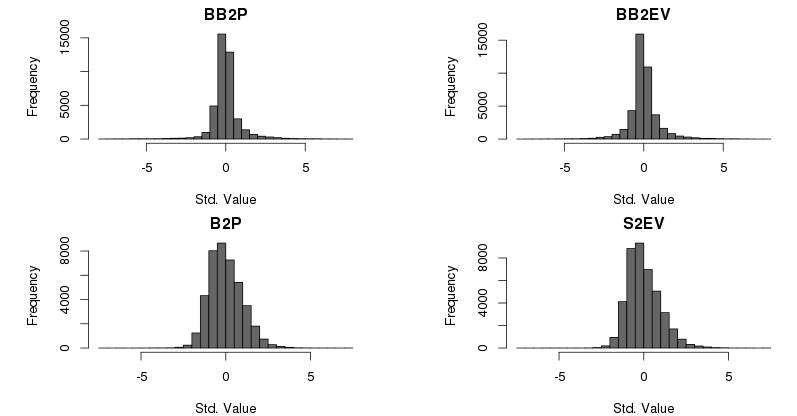

Distribution of the Value Factors

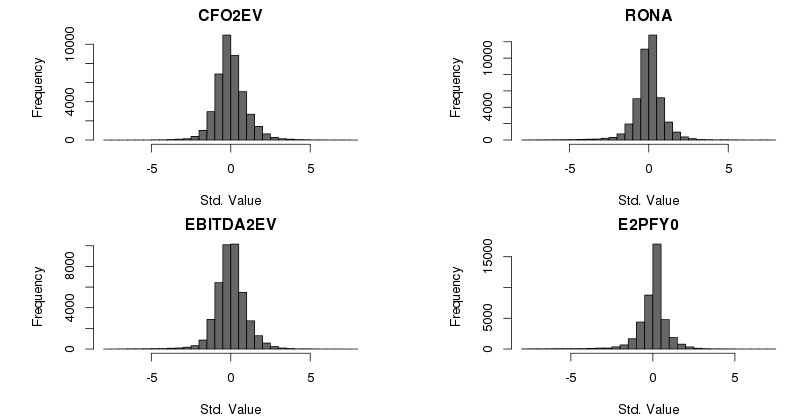

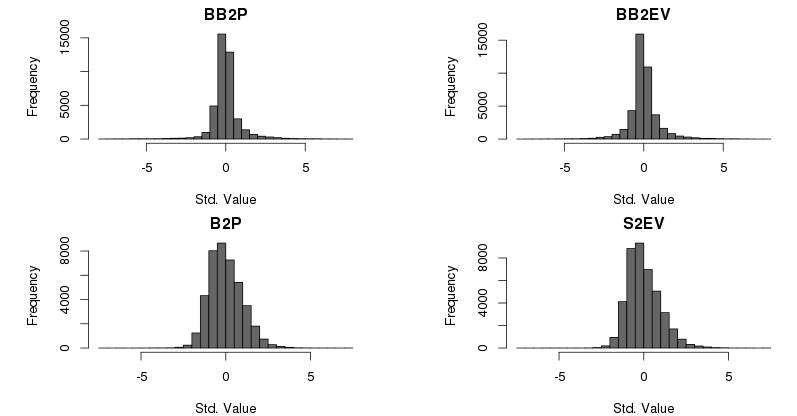

The plots below show the distributions of the standardized value factors synthesized from the

corporate values from the S&P 500 stock universe over the period 1998

through 2013 (a distribution is standardized by subtracting the mean

and dividing the result by the standard deviation).

Ian Kaplan

October 2013

Last revised: February 2014

Back to topics in Quantitative Finance